Brilliant Strategies Of Info About How To Apply For Tin Philippines

How to get a tin number in the philippines:

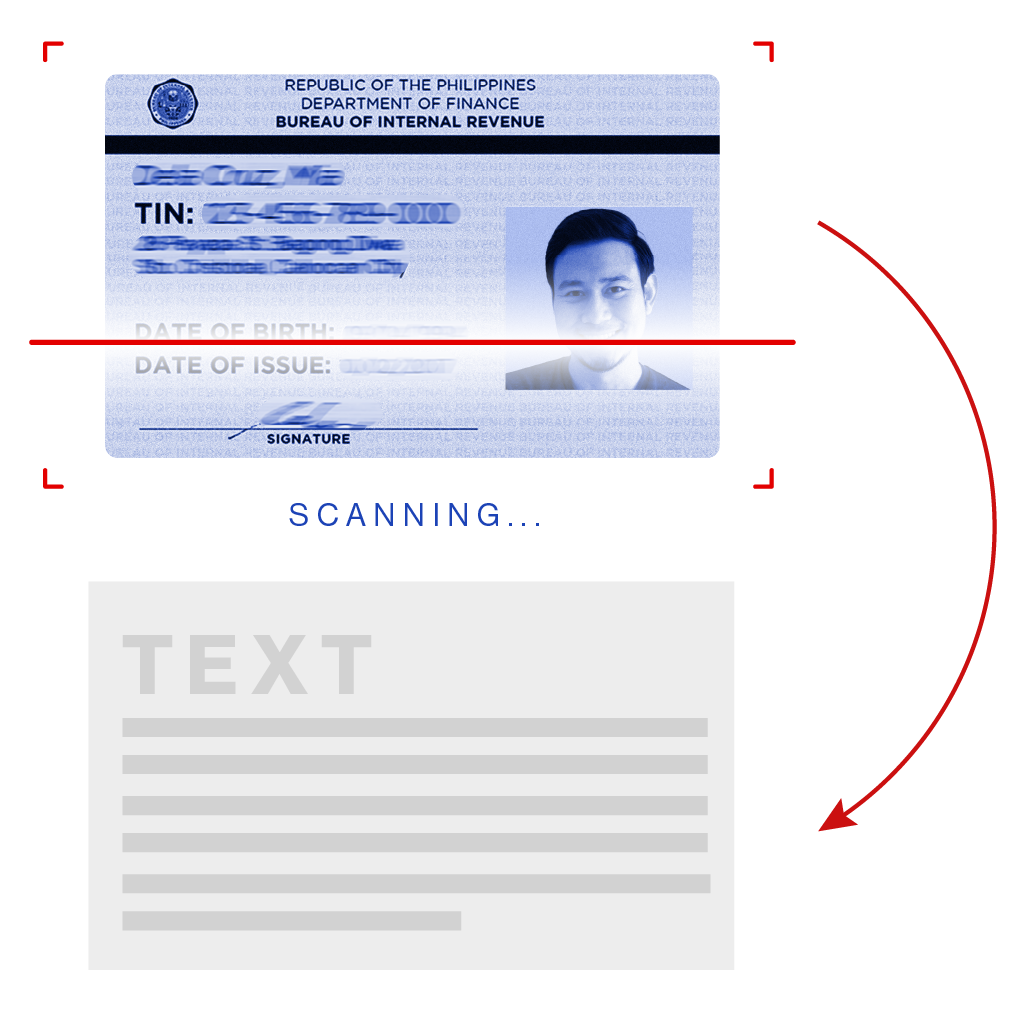

How to apply for tin philippines. Here are the documents you need to prepare for a tin id application: Only individual taxpayers with an existing tin (no need to own a card) can apply for the digital tin id through orus. In order to obtain a tax identification number (tin) in the philippines, you will need to fill out and submit a tin application form.

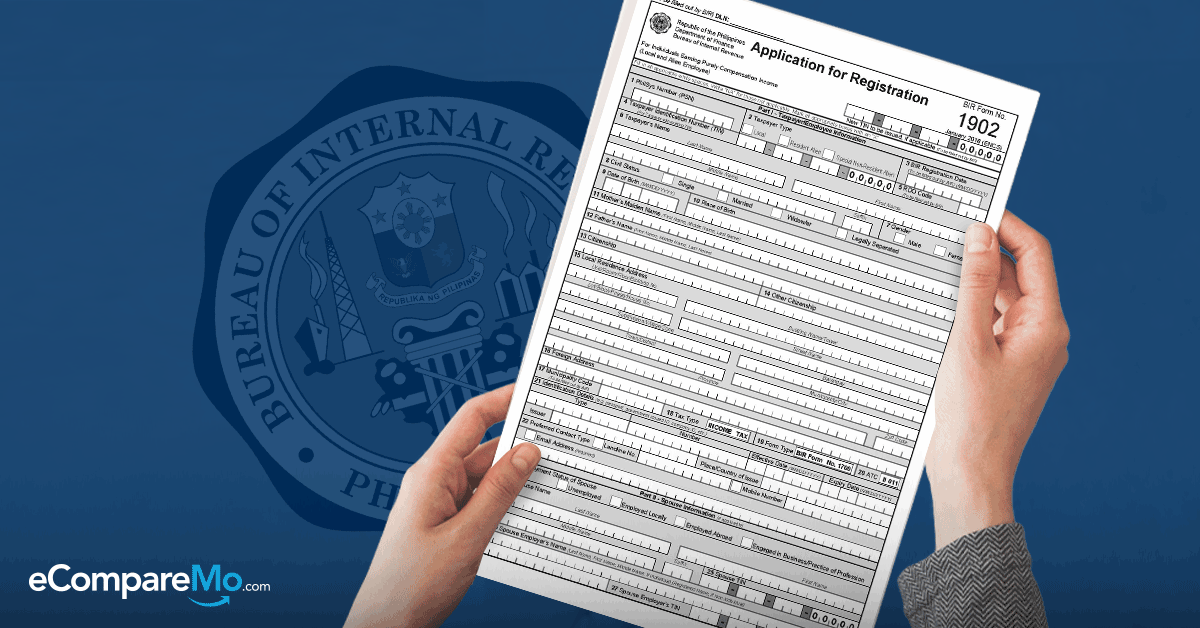

Index for application for taxpayer identification number (tin): The usual method is going to the nearest bir to file your application but many are now using the second method.

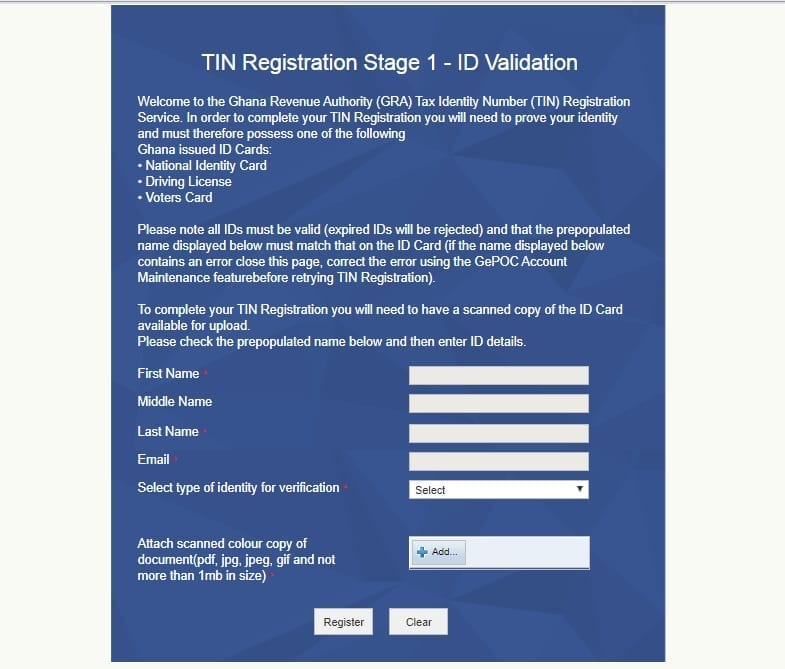

Submit the bir form and the required documents to the nearest revenue district office (rdo). The eregistration (ereg) system is a web application system for various taxpayer registration services, such as. Read on and find out how to apply for a tin.

Since this is a permanent number, there is no need to request a new tin down. If you are a filipino citizen or. How do you get a tin if you're unemployed?

Welcome to bir eregistration system. Each tin issued is final and does not expire. Secondary registration • registration of book of accounts • application for.

Any filipino citizen can apply for free. Table of contents. Updated form s1905 (registration update sheet) to be submitted to your rdo (regional/district offices) through their physical office or using.

The form is available at most tax. Companies want a tin from every applicant. Embarking on the journey to secure your digital tin id requires understanding who’s eligible and what you need beforehand.

To apply for a job: Employers check the data with the issuing organization. Tin application using bir form 1901.

![Eng Bee Tin Menu Prices Philippines 2023 [Updated] — All About](https://menuph.com/wp-content/uploads/2022/09/eng-bee-tin-menu-price-philippines.jpg)