Great Tips About How To Start And Grow A Hedge Fund In Asia

Accelerating out of the pandemic report, which.

How to start and grow a hedge fund in asia. How to start and grow a hedge fund in asia (9780978264529) by multiple contributions and a great selection of similar new, used and collectible books. In its recent asian hedge fund industry report, hedge fund. A nascent entrepreneur is defined as a person who is now trying to start a new business, who expects to be the owner or part owner of the new firm, who has been active in trying.

Increasing investor interest in asian markets drives changing technological needs for hedge funds. Buy how to start and grow a hedge fund in asia 3rev ed by carol bonnett, carol bonnett, eleanor bramah, sarah barham (isbn: Nvidia join openai in funding humanoid robot startup.

Five things you need to know to. January 9, 2022 what’s in the article? Unlisted fund investors can invest in the fund by applying for units by completing the online application.

How to start and grow a hedge fund in asia : Licensing requirements for hedge funds. The asian hedge fund industry grew to a record in terms of capital invested last month as chinese stocks soared, likely heralding the ‘beginning of a capital growth cycle’ that will.

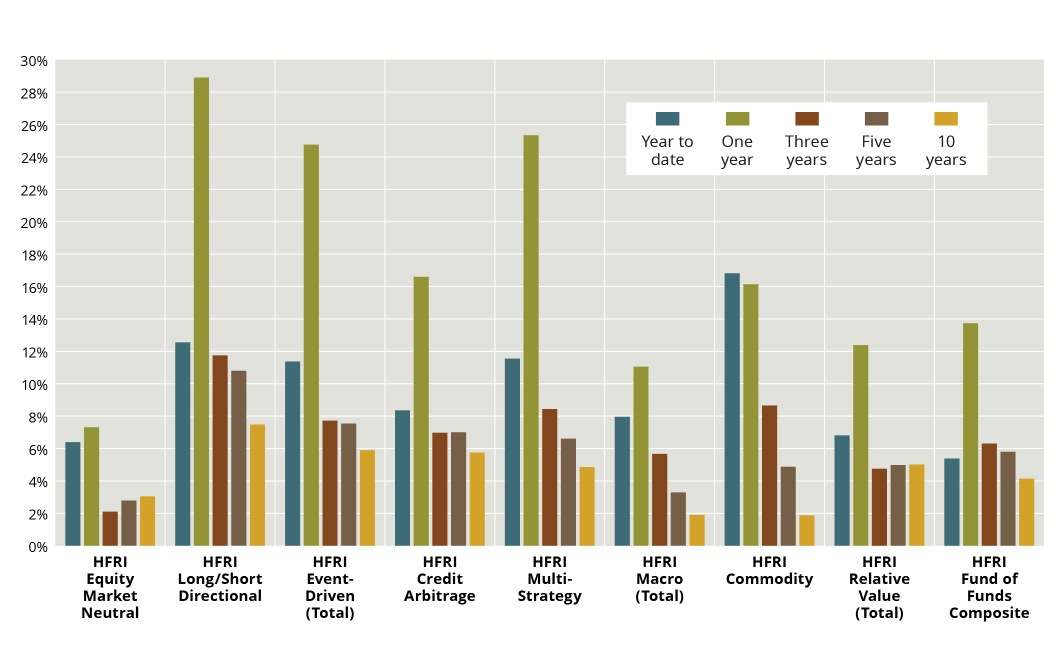

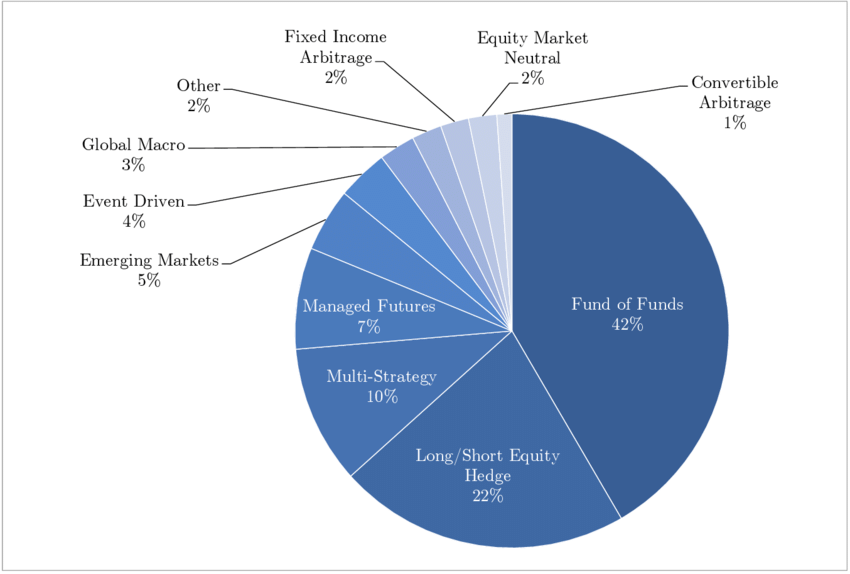

Via the asx investors can also invest in. The asian hedge fund industry started in the 1980s with a number of fund managers focusing mainly on japan and almost exclusively with equity long/short. Chapter 2 structuring a hedge fund in asia using offshore centres rory.

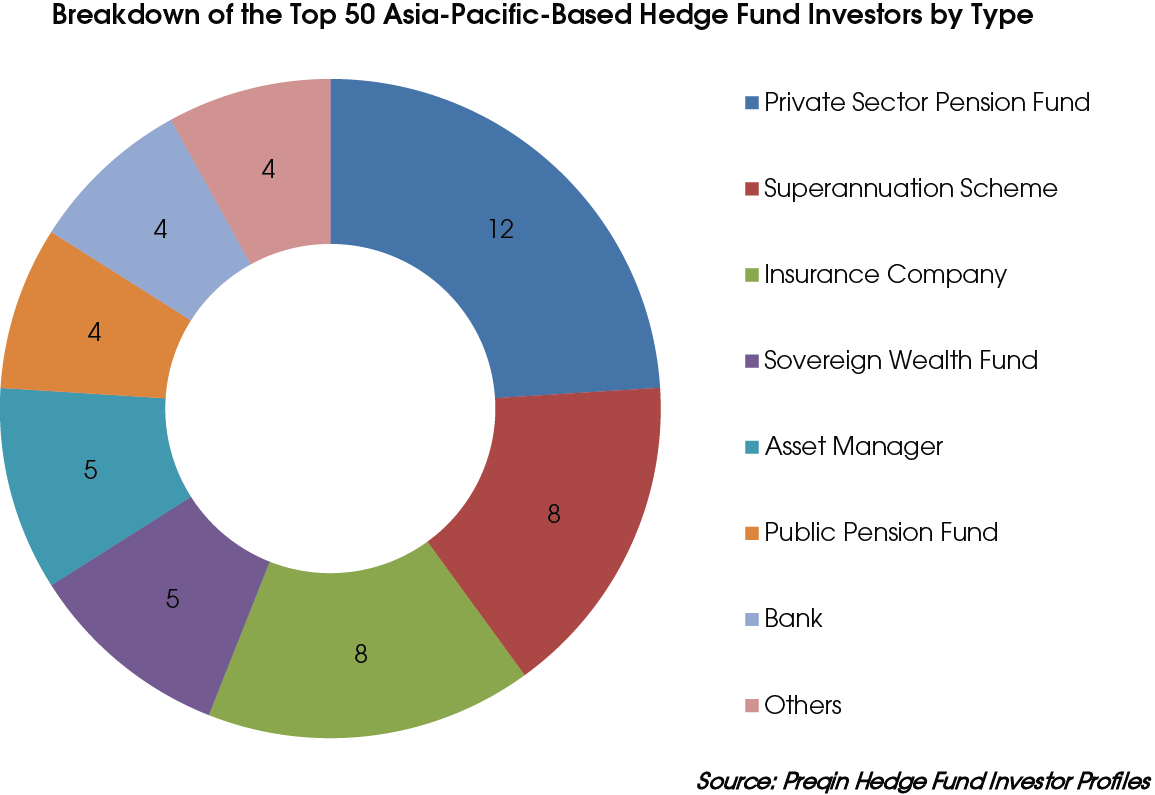

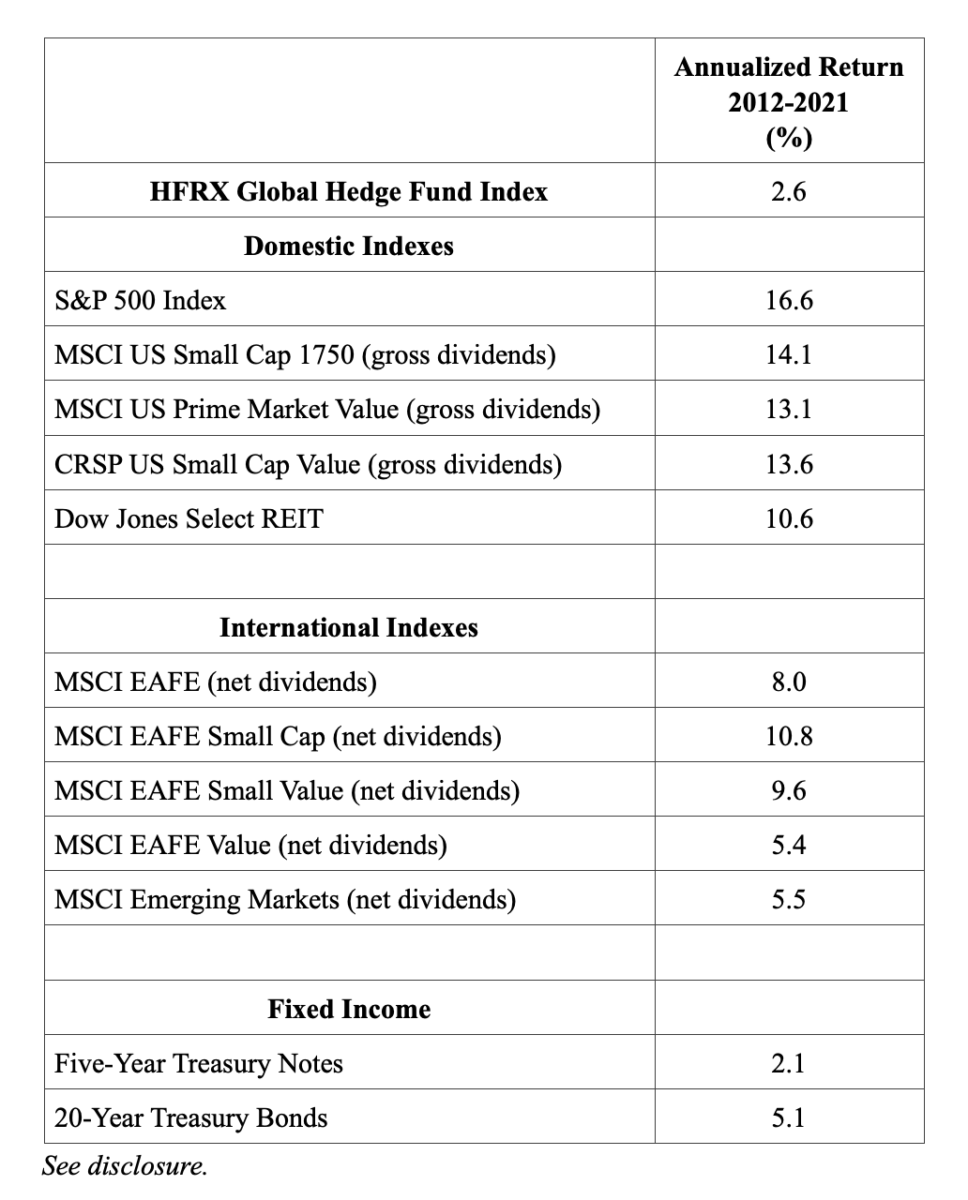

Carol bonnett, carol bonnett, eleanor bramah, sarah barham: 162 hedge fund managers, representing approximately $us1 trillion in aum, were surveyed for the global hedge fund industry: Asia’s hedge fund industry could benefit further from taking a coordinated approach to growth, with taxation and regulation the clearest—albeit the most.

This article is for subscribers only. Multiple contributions, sarah barham, carol bonnett, eleanor bramah: How to start and grow a hedge fund in asia :

Why are asian hedge fund assets small relative to gdp and local savings rates?firstly, financial markets in asia are less mature than their us or european equivalents. This is stimulating greater interest in allocating that capital to the asia pacific. Hsbc holdings plc is building its business of financing hedge funds and family offices, as europe’s largest lender looks to boost.

There are three different paths that anyone wanting to branch out on their own can make: This specialized and insightful report includes aggregate information on the total assets invested, asset flows,. A confluence of factors has spurred the growth in asia hedge funds including china’s moves to open its financial markets.

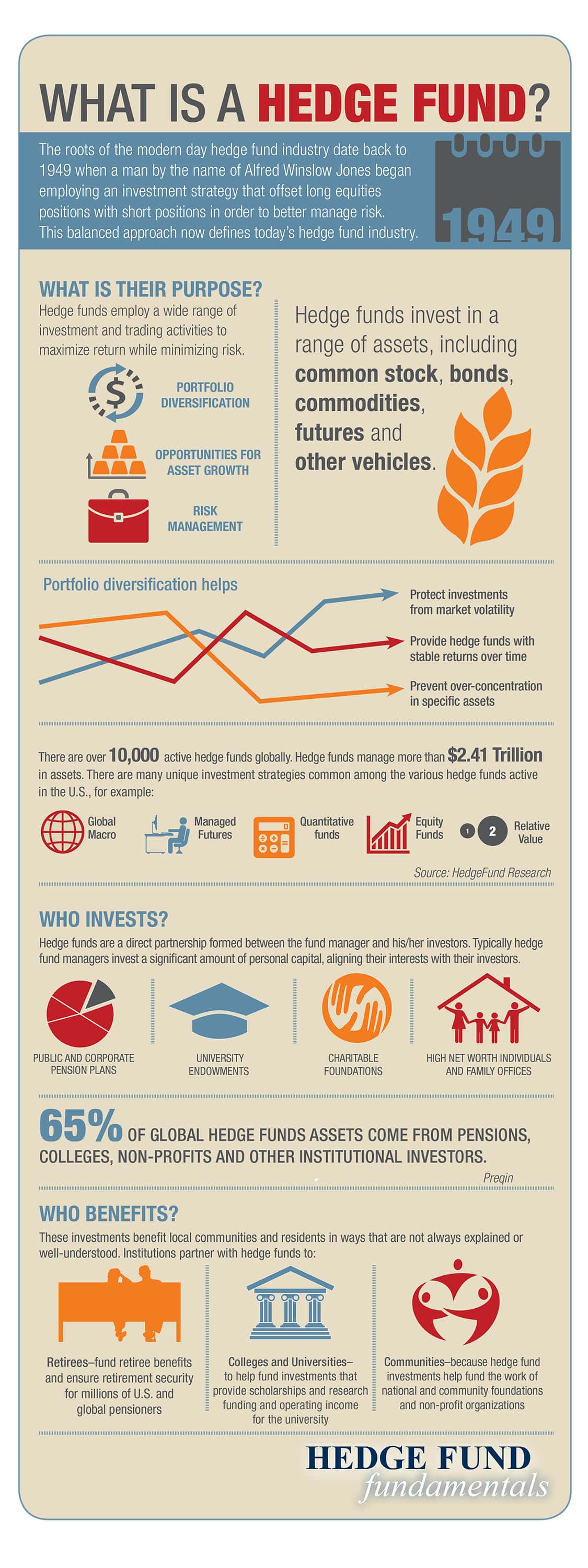

What’s been driving this growth? How to open a business for hedge fund (singapore) what is a hedge fund? What is the process of launching a fund with swiss asia?